Haryana Minimum Wages have been release 1st Sep 2021 effective from 1st July 2021 to 31st Dec 2021

CLICK ON THE BELOW LINK FOR MORE DETAILED INFORMATION:

Harayana-Minimum-Wages-1st-July-2021-to-31st-Dec-2021

Courtesy: PRAKASH CONSULTANCY SERVICE

Haryana Minimum Wages have been release 1st Sep 2021 effective from 1st July 2021 to 31st Dec 2021

CLICK ON THE BELOW LINK FOR MORE DETAILED INFORMATION:

Harayana-Minimum-Wages-1st-July-2021-to-31st-Dec-2021

Courtesy: PRAKASH CONSULTANCY SERVICE

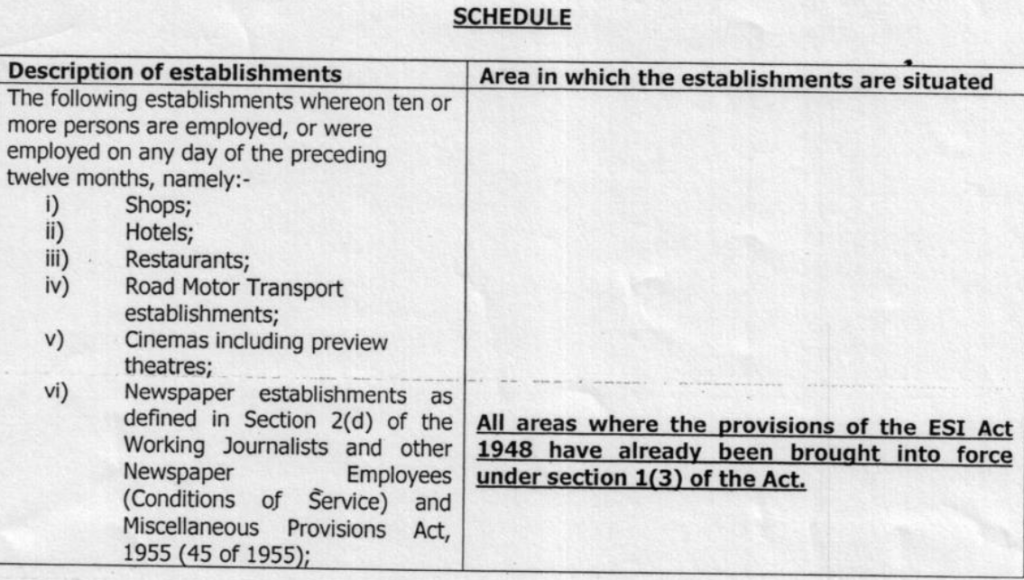

A notification of the Government of Manipur vide even number dated 29“ December 2020, the State Government in consultation with the Employees’ State Insurance Corporation and with the approval of the Central Government gave notice to is the intention to extend the provisions of the Employees’ State Insurance Act, 1948 (34 of 1948) to Municipal Corporation, Municipal Board, Municipal Council, and other Local bodies controlled by the State Government.

And whereas, no objections and suggestions have been received within the said period of 1 (one) the month of the said notification.

In the exercise of the power conferred by sub-section (5) of Section-1 of the Employees’ State Insurance Act, 1948 (34 of 1948), and in supersession of all previous notification issued In this regard, the State Government of Manipur, and in consultation with the Employees State Insurance Corporation and with the approval of the Central Government hereby extends the provisions of the said Act to the classes of establishment specified in Column (1) and situated within the areas specified in Column (2) of the Schedule in the State of Manipur as detailed below with immediate effect.

CLICK ON THE BELOW LINK FOR MORE DETAILED INFORMATION:

esic-provision-extended-to-certain-establishments-and-local-bodies-in-Manipur

Courtesy: PRAKASH CONSULTANCY SERVICE

Amendment of rule 281(1)

Addition of rules 298, 299, 300, 301 and 302

CLICK ON THE BELOW LINK FOR MORE DETAILED INFORMATION:

Courtesy: PRAKASH CONSULTANCY SERVICE

Amendment in the Delhi Shops and Establishments Rules, 1954 are as follows: –

• In Rule 3 which specifies “Form of submitting statement and other particulars”, has been substituted, namely: –

“The occupier of the establishment, within 90 days of the commencement of work of his establishment shall apply for the registration under the Act, online on the Shop and Establishment Portal of Labour Department”.

• In Rule 4 which specifies “Manner of registering establishments and form of registration certificate”, has been substituted, namely: –

“On submission of application online on the Shop & Establishment portal of Labour Department, Government of NCT of Delhi, the registration certificate shall be generated online in Form C”.

• In Rule 6 which specifies “Form and manner of notifying change”, has been substituted, namely: –

“The occupier shall notify any change in respect of any information under subsection (1) of section 5 of the Act within 30 days after such change has taken place, online, on the Shop & Establishment Portal of Labour Department, Government of National Capital Territory of Delhi”.

• In Schedule I, II has been omitted.

The objection & suggestion will be taken up for consideration, after the expiry of a period of 15 days from the date of publication of this notification in the Delhi Gazette should be addressed to the Additional Secretary (Labour), C-Block, 5, Sham Nath, Marg, Delhi-110054.

CLICK ON THE LINK Draft-notification-of-the-Delhi-Shops-and-Establishments-Amendment-Rules-2021dated-24.09.2021-Govt.-of-Delhi.

Courtesy: PRAKASH CONSULTANCY SERVICE

checkout the link for more information: http://www.sensystechnologies.com/blog/wp-content/uploads/2021/09/DETAILS-OF-TIE-UP-PATHOLOGY-LABORATORYDIAGNOSTIC-CENTERS-FOR-ESI-BENEFICIARIES-FOR-ALL-GUJARAT-REGION.pdf

SOURCES: PRAKASH CONSULTANCY SERVICES

The credit of TDS to be given for the assessment year in which invoices are raised

In terms of Rule 37BA(3)(i) benefit of TDS is to be given for assessment year for which corresponding income is assessable, therefore, where the assessee raised invoice on ‘A’ in March 2011, the benefit of TDS had to be allowed in the assessment year 2011-12 even though the tax on invoice amount was deposited by ‘A’ in April 2011. So, in no case TDS credit can be given in other assessment years.

Assessee to reconcile income vis-à-vis TDS credit

Total freight collected by the assessee was Rs.30.53 crores and that the assessee paid freight to shipping companies at Rs.25.56 crores thus resulting in a balance of Rs.4.97 crores as gross income in its Profit and Loss Account, which was not disputed by the Assessing Officer.

The Assessing Officer did not allow full TDS credit of Rs.76,16,380/- to the assessee, as in the opinion of the Assessing Officer, since the assessee had not accounted for the entire gross receipts of Rs.30.53 crores it was not entitled to claim the full TDS credit of Rs.76,16,380/- and the Assessing Officer restricted the TDS credit to Rs.12,37,993/-

Even in various appeals TDS credit was not allowed as it is the responsibility of the assessee to reconcile TDS credit with income exposed to tax. The onus is on the assessee to make proper reconciliation of the differences between the receipts as per TDS certificates and that of as per Profit and Loss Account lay relevant evidence/material in support of its contentions/explanation.

No denial of TDS even in the absence of Form 16A (TDS certificates)

The Gujarat High Court in the case of Sumit Devendra Rajani v. Asstt. CIT [2014] 49 taxmann.com 31 (Gujarat), involving the assessment year 2010-11, held that “where the deductor having deducted TDS, issued Form No. 16A, credit of the same cannot be denied to the assessee-deductee solely on the ground that such credit does not appear on the ITD system of the department and/or the same does not match with the ITD system of the department.”

Any receipts do not become taxable just because TDS is deducted from it

Income and chargeability are two separate terms defined under the Act under 2(24) of the Act and Sec 4 of the Act respectively. Every transaction has to be tested separately as per the definition in the Act and then only the provisions of Chapter XVII- B of the Act can be applied.

If a Fixed Deposit is made by an assessee in the process of setting up a new project as security for opening an L/C for import of Plant and Machinery, then interest on such Fixed Deposit does not constitute income but is liable to be netted off against the cost of setting up of the project. In such cases, the interest on Fixed Deposit does not constitute income under the charging provisions of Section 4 of the Act. In such cases however the Revenue cannot claim the interest to be chargeable to tax under section 4 of the Act even if the Bank deducts tax on such interest income under section 194A of the Act by taking recourse to Sec. 198 of the Act.

Facts:

Analysis of facts:

The person responsible for paying to the non-resident is required to deduct tax at source (section 195); issue certificate for tax deducted to the deductee (section 203); and the credit for tax deducted at source is given to the deductee by treating it as a payment of tax by the deductor on behalf of the deductee (section 199). It clearly emerges that once a deduction of tax at source has been made on behalf of the deductee (payee), the deductor (payer) becomes functus officio and, cannot, under any circumstance, claim a refund of the tax deducted at source. The deduction of tax at source is always a payment of tax by the deductor on behalf of the deductee and it is only the deductee, who is entitled to the credit of tax deducted by the deductor on his behalf for which a certificate is issued to him.

No statutory provision permits the deductor to claim a refund of the excess tax deducted at the source.

There is a vital distinction between two situations viz., one, in which the amount of income is put to tax at a high rate; and two in which the deduction of tax is made from it at a higher rate.

Obviously, the first situation is a cause of concern as no amount of tax more than what is rightfully due to the exchequer, can be recovered.

On the other hand, the second situation simply encompasses a payment of tax on behalf of the deductee without impacting his tax liability in any manner. If such a deduction has voluntarily been made at a higher rate, the deductee, at the time of filing his return, is always entitled to claim the benefit of TDS and the resultant refund, if any due to him.

Conclusion:

The ITAT Delhi Bench in the case of Computer Sciences Corporation India (P.) Ltd. v. ITO [2017] 77 taxmann.com 306 (Delhi – Trib.) held that once the tax has been deducted at source and certificate of such deduction is issued to the deductee, only the deductee can claim the benefit of deduction of tax at source and in no circumstances the deductor can claim any refund out of the excess amount of tax deducted at source on behalf of the deductee.

Facts of the case:

S had engaged the services of the assessee for collection of the subscription amount against the commission and the assessee had remitted the entire gross amount received from the cable operators to S. The amount remitted by the assessee to S included the number of TDS deducted by the cable operators at the time of payment made by them to the assessee.

The assessee company filed its return of income for the assessment year 2010-2011 on 24.09.2010 declaring an income of Rs.13,62,81,800/-. The Assessing Officer while computing the assessment under section 143(3) of the Act, assessed the income at the same figure of Rs.13,62,81,800/- However, the Assessing Officer had not allowed the assessee’s claim of credit for TDS of Rs.2,46,80,256/- on the ground that the concerned income was not offered to tax in the return of income. The Assessing Officer in his order on noticing that the assessee had not included the subscription charges of Rs.86,34,97,146/- corresponding to the TDS amount of Rs.2,46,80,256/- in the Profit and Loss account, disallowed the credit for the corresponding TDS.

Arguments in favor of allowing TDS credit are as below:

Aggrieved, the assessee preferred an appeal before the Commissioner of Income Tax (Appeals) and finally to High Court.

Analysis of facts:

Conclusion:

Thus, the assessee was entitled to receive a credit of the tax deducted at source under section 199 of the Act subject to production of TDS Certificates received from respective deductors.

Case 1 – Diversion of income by overriding title:

Facts of the case: the assessee is an individual, engaged in retail business and earned income from franchisee/commission from M/s. Arvind mills. The assessee filed a return of income on 29.9.2009 declaring a total income of Rs. 1,19,89,080/-. The scrutiny assessment of the case was completed on 23rd December 2011. The detail of commission income offered to assessment is given below:

| Particular of income | Actual income received | Income credited to P&L |

| Commission from M/s. Arvind mill | Rs. 2,61,18,048/- | Rs. 1,53,18,478/- |

| Amount of commission transferred to the stepson of the assessee

(in compliance to the direction of the High Court given in a dispute) |

Less: Rs. 1,07,99,570/- | |

| TDS credit allowed | Rs. 17,35,607/- | |

| TDS claim rejected invoking section 199 | Rs. 12,23,608/- |

Analysis of facts:

Section 199 and rules made there under not applicable: subsection 2 and 3 of the section are not applicable to the facts of the case in hand. Further, sub Rule (2) and (3) of Rule 37BA of the Income-tax Rules are also not applicable to the facts of the case in hand, as the income of the assessee is not falling under any of the clauses of sub Rule (2) and the issue of credit in multiple years is also not involved in the case in hand.

TDS credit shall be given to the person from whose income deduction was made: The first limb of section 199(1) refers to the tax deducted and paid to the Central Government. The second limb of the subsection refers to allowing credit of the tax so deducted and paid to the central government, in the hands of the person from whose income, the tax has been deducted. So, a plain and literal interpretation of subsection (1) of section 199 leads to the result that the credit of the tax deducted has to be given in the hands of the deductee i.e. the person from whose income the deduction was made. Thus, said subsection nowhere says that credit of TDS should be restricted only to the amount of income or receipt offered in the return of income or in the Profit and Loss Account.

TDS credit shall be allowed based on the information provided by the deductor (Rule 37BA(1)): Further, sub-rule (1) of Rule 37BA of the Rules also emphasize allowing the credit in the hands of the deductor on the basis of the information related to deduction of tax furnished by the deductor

Neither party should be made unjust enriched at the cost of the other: the credit of the Rs. 12,23,608/- is allowable in the hands of the assessee, in view of the clear provisions of subsection(1) of section 199 of the Act and Rules made thereunder. However, we direct the assessing officer to verify whether any credit of the TDS of Rs. 12,23,608/- has been allowed by the Income-tax Department in the hands of Shri Kapil Ahluwalia or not. If it has been not allowed, then the credit of this amount should be given in the hands of the assessee.

Case 2: TDS deducted on payment of mobilization advance

Where TDS was deducted from mobilization advance paid to the assessee who was an erection contractor, credit of same was to be allowed, even if no income was assessable to tax as the contract was not fully executed in the relevant year.

Case 1: The assessee had been taking contracts in its name as well as in the names of its director and the Assessing Officer agreeing with the contentions of the assessee that as both the receipts were deposited in the assessee company’s accounts it was entitled to claim credit of TDS reflected in Form 26AS in the case of the director passed the Assessment Order for the assessment years 2010-11 and 2011-12 subject to verification that TDS had not been claimed by the director.

Against such directions, the assessee filed appeals before the Commissioner of Income-tax (Appeals). Though the appeals were allowed by the Commissioner of Income-tax (Appeals), the issue of claiming and granting of TDS credit in the account of the director as appearing in Form 26AS in the hands of the assessee was not the subject matter of the appeal.

As the assessment orders passed by the Assessing Officer were found to be erroneous and prejudicial to the interest of the Revenue, the Principal Commissioner of Income-tax, exercising his jurisdiction under section 263 of the Act, issued a notice to the assessee and by virtue of his order directed the Assessing Officer to revise the assessment by giving credit to the extent of TDS certificate issued in the name of the assessee only and withdraw the TDS certificate in the name of the director.

The Tribunal also held at para.17 of its order as under-

“There is no denial in the written submissions filed by the assessee before the Principal Commissioner of Income-tax and before us that at the relevant time, the order was passed by the Assessing Officer, Rule 37BA was applicable. Further, the assessee has failed to mention that the case of the assessee would fall in any of the ingredients mentioned in Rule 37BA, as reproduced by the Principal Commissioner of Income-tax in para 2 of the impugned order. In view of the legal position, the opinion formed by the Principal Commissioner of Income-tax that the order passed by the Assessing Officer was erroneous and prejudicial to the interest of revenue cannot be faulted”

Thus, the issue was answered against the assessee, and TDS reflecting in 26AS of the director was not given to the assessee company.

Case 2: The facts of the case which arose before the Madras High Court in Madura Coats Ltd. v. CIT [1986] 25 Taxman 200 (Mad) were the assessee company was formed by the amalgamation of three companies. The amalgamation took place on January 1, 1975, with retrospective effect from July 1, 1974. During the accounting year relevant to the assessment year 1976-77, two of the three companies which held shares in the third company were entitled to dividend income on the said shares, and on the said dividend income, the tax was deducted at source. This dividend was declared at the annual general meeting of the company held on December 27, 1974.

The assessee’s claim before the Assessing Officer that the dividend income could not be taken as its income but the tax deducted at source from the said dividend should be given credit to in its assessment was rejected by the Assessing Officer who held that the dividend was the income of the amalgamated company as per the terms of the amalgamation.

The Commissioner of Income-tax (Appeals), however, directed the Assessing Officer to exclude the dividend income from the total income of the assessee and as regards the tax deducted at source, he held that the proper person should approach the concerned authority for a refund of the tax wrongly deducted.

The Tribunal held that the tax deducted at source could not be given credit to the assessee in whose hands the dividend income had not been taxed.

The High Court, dismissing the petition, held that the finding of the Tribunal that the dividend income could not be treated as the income of the amalgamated company viz., the assessee, automatically resulted in the tax deducted at source from the said gross dividend not being part of the assessee’s income. The tax deducted at source could be given credit only in the case of the company in whose hands the income was to be assessed and as per section 198 of the Income-tax Act, 1961, the tax deducted at source would be the income received by the erstwhile companies which owned the shares in respect of which the dividend was declared. Accordingly, credit for the tax deducted at the source from the said dividend could not be given to the assessee.

Case 3: The Madras High Court in the case of CIT v. Tanjore Permanent Bank Ltd. [1987] 30 Taxman 265 (Mad.) held that:

“It is well settled that a tax credit can be given only in cases where the tax is paid on the income in respect of which tax has been deducted at source and which is offered for assessment.”

The assessee-bank, in this case, advanced money to its constituents, bought bonds of Electricity Board for them but in its own name, kept them in its own custody but the real and beneficial owners were the said constituents and the assessee-bank claimed credit for tax deducted at source on interest income of the said bonds through interest income from the said bonds had not been included by the assessee in its return. The Assessing Officer allowed credit for the said tax deducted at source but subsequently withdrew it by passing an order under section 154 of the Act. The High Court, reversing the order passed by the Tribunal, held that giving credit of tax deducted at source on the said interest income which had not been included in assessee’s total income amounted to a mistake apparent from record amenable to rectification under section 154 of the Act by the Assessing Officer.