|

|

Due dates for the Month of May 2017

|

|

5th

|

Service Tax – Service Tax payments by Companies for April |

| Central Excise# – Duty Payment for all Assessees other than SSI Units for April |

|

|

7th

|

Income Tax – TDS Payment for April |

|

10th

|

Central Excise – Monthly Return in Form ER-1 (Ann-12) for other than units availing SSI exemption for April – Monthly Return in Form ER-2 (Ann-13) by 100% EOUs for April – Exports – Procurement of specified goods from EOU for use in manufacture of Export goods in Form Ann-17B for DTA units, procuring specified goods from EOU for manufacture of export goods. – Proof of Exports in Form Ann.-19, once in a month for all exporters, exporting goods under Bond – Export details in Form Ann.-20, for Manufacturing following simplified export procedure. – Removal of excisable goods at concessional rate in Form Ann. -46 for Manufacturers receiving the excisable goods for specified use at concessional rate of duty in terms of Rules described in Col. 4. |

|

15th

|

Providend Fund – PF Payment for April |

|

21st

|

ESIC – ESIC Payment for April MVAT – MVAT Monthly Payment & Return for April |

|

31st

|

Income Tax – TDS / TCS Quarterly Statements (Other than Government Deductor) January to March Profession Tax – Monthly Return (covering salary paid for the preceding month) (Tax Rs. 50,000 or more) Central Excise – Particulars relating to clearances, electricity load etc., in Form Ann.-4 exceeding the limit of Rs. 90 lakhs of exempted clearances for small scale units availing exemption and whose turnover exceeds or has exceeded Rs. 90 lakhs in a financial year, as the case may be. |

| # If Excise duy / Service tax paid electronically through internet banking, the date is to be reconed as 6th instead of 5th | |

|

Software Solutions Available on:

TDS | PAYROLL | WEB PAYROLL | WEB HRMS | XBRL | FIXED ASSET |INCOME TAX| SERVICE TAX | DIGITAL SIGNATURE | ATTENDANCE MACHINE & CCTV | DATA BACKUP SOFTWARE | PDF SIGNER |

|

|

Sensys Technologies Pvt. Ltd.

HO: 524, Master Mind1, Royal Palms, Goregaon East, Mumbai – 400 065. Tel.: 022-66278600 | Call: 09769468105 / 09867307971 Email: sales@sensysindia.com | Website: http://www.sensysindia.com Branches: Delhi & NCR | Pune | Bangalore | Hyderabad | Ahmedabad | Chennai | Kolkata |

|

|

Visit our BLOG for latest news and updates related to XBRL, Income Tax, HR & Payroll, PF / ESIC / TDS / PT etc.. Click here to visit Sensys BLOG

|

|

Significance of place of supply in IGST taxation

IGST stands for Integrated Goods and Service Tax. Supplies where location of supplier and place of supply are in different taxing state will come under the levy of IGST. Thus, determination of correct place of supply plays vital role to ensure that IGST is correctly levied and thereby correctly apportioned to consumer state.

The basic principle of GST is that it should effectively tax the consumption of above supplies at the destination thereof or as the case may at the point of consumption. In simple words tax should reach in the state where goods and / or services are actually consumed. So place of supply provision determine the place i.e. taxable jurisdiction where the tax should reach.

For instance, in the case of organization of IPL events, place of consumption is each of those states where IPL matches are actually organized. Hence, under the doctrine of taxing at the point of consumption the tax shall be received by all those states where IPL matches are organized.

Goods being tangible do not pose any significant problems for determination of their place of consumption as there is clearly identified movement of goods from origin state to destination states evident by transport documents which can be hardly manipulated subsequently. Hence, following simple rules are made with respect to determination of place of supply in case of movement of goods:

Place of supply of goods

- Where the supply involves movement of goods, whether by the supplier or the recipient or by any other person, the place of supply of goods shall be the location of the goods at the time at which the movement of goods terminates for delivery to the recipient.

- Where the goods are delivered by the supplier to a recipient or any other person, on the direction of a third person, whether acting as an agent or otherwise, before or during movement of goods, either by way of transfer of documents of title to the goods or otherwise, it shall be deemed that the said third person has received the goods and the place of supply of such goods shall be the principal place of business of such person.

- Where the supply does not involve movement of goods, whether by the supplier or the recipient, the place of supply shall be the location of such goods at the time of the delivery to the recipient.

- Where the goods are assembled or installed at site, the place of supply shall be the place of such installation or assembly.

- Where the goods are supplied on board a conveyance, such as a vessel, an aircraft, a train or a motor vehicle, the place of supply shall be the location at which such goods are taken on board.

- Where the place of supply of goods cannot be determined in terms of sub-section (2), (3), (4) and (5), the same shall be determined by law made by the Parliament in accordance with the recommendation of the Council.

From the above it is evident that in case of supply of goods by physical movement place of supply could be one of the following:

- Location of goods at the time at which movement of goods terminates for delivery to the recipient

- Principle place of the third person on whose direction goods are delivered

In cases where there is no physical movement of goods the place of supply shall be the location of goods at the time of delivery of goods to the recipient.

In the case of goods assembled or installed at site, the place of supply shall be the place of such installation or assembly.

Finally, where the goods are supplied on board a conveyance, the place of supply shall be the location at which such goods are taken on board.

Apportionment of tax collected as IGST between central government and state government

IGST as we know is levied on every interstate supply of goods which is equal to CGST and SGST paid under normal transaction of intra state supplies. In case recipient is also a taxable person and eligible for input tax credit he will utilized IGST paid on input supply for paying his tax liability on outward supply.

However, in case any balance exist in IGST account even after utilization or recipient is unregistered dealer or not eligible for input tax credit, the balance outstanding in IGST account shall stand apportioned between central government and state government as provided under section 10. Thus, ultimately the consumer state will be the state that will enjoy the tax component in intra state supply.

The relevant portion of section is reproduced below to understand to principles of apportionment of IGST:

Section10. Apportionment of tax collected under the Act and settlement of funds

(1) Out of the IGST paid to the Central Government in respect of inter-State supply of goods and/or services to an unregistered person or to a taxable person paying tax under section 8 of the CGST Act, the amount of tax calculated at the rate equivalent to the CGST on similar intra-state supply shall be apportioned to the Central Government.

(5) The balance amount of tax remaining in the IGST account in respect of the supply for which an apportionment to the Central Government has been done under sub-section (1), (2) or (3) shall be apportioned, in the manner and time as may be prescribed, to the State where such supply takes place as per section9 5 or 6.

Meaning and significance of supply under GST

Supply – Taxable event:

As per section 8(1) of the revised GST act, the supply of goods or services is a taxable event. It states that – There shall be levied a tax called the Central/State Goods and Services Tax (CGST/SGST) on all Intra-State supplies of goods and/or services on the value determined under section 15 and at such rates as may be notified by the Central/State Government in this behalf, but not exceeding fourteen percent, on the recommendation of the Council and collected in such manner as may be prescribed.

Hence, liability to pay have been shifted from sale (as in case of existing sales tax / VAT act) or provision of services (as in the case of service tax) or manufacture (as in the case of excise duty etc.) to supply of goods or services. Hence, here an attempt is made to understand the meaning of term supplies.

What is supply under GST?

Section 3(1) of the act provides an inclusive definition of the term supply. As per definition given in section 3, all supplies may be categories under three heads:

| Supplies – where consideration is necessary | Supplies – where consideration is not necessary | |

| In the course or furtherance of business | Not in the course or furtherance of business | |

| 1. Sale,

2. Transfer, 3. Barter, 4. Exchange, 5. License, 6. Rental, 7. Lease or 8. Disposal 9. Importation of services |

1. Importation of services | 1. Permanent transfer/disposal of business assets where ITC has been availed on such assets2. Supply between related person or distinct person made in the course or furtherance of business.3. Supply of goods by principle to his agent or vice versa, where agent undertakes to supply / received such goods on behalf of the principle.

4. Importation of services by a taxable person from – a. A related person b. Any of his other establishment outside India |

All above activities shall be treated as supply and GST will be attracted as the provisions of the GST act.

What is not supply under GST?

Schedule III and Schedules IV specifies activities and transactions which are not to be treated as supply and hence to not liable for GST. Few such items are given below:

| Activities undertaken by any person | Following activities are undertaken by central government or state government or any local authority to: | ||

| 1. Services by an employee to the employer2. Services by any Court or Tribunal3. Function / duties performed by:

a. MP / MLA b. Members of Panchayats c. Members of Municipalities d. Members of other local authorities e. Post as provided under constitution 4. Services by a foreign diplomatic mission 5. Services of funeral, burial, crematorium or mortuary |

1. Another government or local authority excluding services of post, transport | 1. To individual in discharge of statutory function. | 1. Health care2. Education etc. |

What is composite supply?

As per sec 2(27) “composite supply” means a supply made by a taxable person to a recipient comprising two or more supplies of goods or services, or any combination thereof, which are naturally bundled and supplied in combination with each other in the ordinary course of business, one of which is a principal supply;

Case 1: Where goods are packed and transported with insurance, the supply of goods, packing materials, transport and insurance is a composite supply and supply of goods is the principal supply.

A composite supply comprising two or more supplies, one of which is a principal supply, shall be treated as a supply of such principal supply.

What is mix supply?

As per sec 2(66) “mixed supply” means two or more individual supplies of goods or services, or any combination thereof, made in combination with each other by a taxable person for a single price where such supply does not constitute a composite supply;

Case 2: A supply of a package consisting of canned foods, sweets, chocolates, cakes, dry fruits, aerated drink and fruit juices when supplied for a single price is a mixed supply. Each of these items can be supplied separately and is not dependent on any other. It shall not be a mixed supply if these items are supplied separately.

A mixed supply comprising two or more supplies shall be treated as supply of that particular supply which attracts the highest rate of tax.

Taxation of Dividend

What is dividend?

Dividend, as understood generally, means the amount paid to or received by a shareholder in proportion to his shareholding in a company, out of the total sum so distributed.

Income tax act provides an inclusive definition of the term dividend. This means, a particular distribution if not regarded as dividend as per the the extended meaning provided under sec 2(22) of the act but if cover by ordinary meaning as given above, still it shall be regarded as dividend.

As per sec 2(22) dividend includes:

- Any distribution entailing the release of a company’s assets

- Any distribution of debenture, debenture stock, deposit certificates and bonus to preference shareholders

- Distribution on liquidation of company

- Distribution on reduction of capital

- Any payment by way of loan or advance by a closely held company to a shareholder holding substantial interest provided the loan should not have been made in the ordinary course of business and money lending should not be a substantial part of the company’s business.

How dividend income is taxable?

If dividend comes under (a) to (d) of above, then under section 10(34) dividend income from an Indian company is not taxable in the hands of shareholders, instead the payer company will pay dividend tax under sec 115-O.

The payment or distribution under above clauses can be treated as dividend only to the extent of accumulated profits of the company. Any payment or distribution beyond accumulated profits shall not be regarded as dividend and can’t be taxed in the hands of payer company.

However deemed dividend falling under section 2(22)(e) of above and dividend from foreign company is taxable in the hands of shareholders u/s 56(2)(i) as income from other sources, regardless of the fact whether shares are held by the assessee as investment or stock in trade. In such cases payer company will not pay tax.

What is tax incidence of dividend?

The tax incidence may be summarized under the following table:

| Particulars | Dividend declared by an Indian Company | ||

| Dividend | Interim Dividend | Deemed dividend u/s 2(22)(e) | |

| Basis of charge | Deemed as income of shareholder in which it is declared. | Deemed as income of the previous year in which the amount is unconditionally made available to the shareholder. | Treated as income of the previous year in which it is so distributed or paid. |

| Taxable in the hands of | |||

| 1. Shareholder | x | x | ✓ |

| 2. Company declaring dividend |

✓ |

✓ |

x |

Any dividend declared by a foreign company is always taxable in the hands of shareholder.

What is tax rate applicable on dividend?

| Dividend(as % of dividend) | Surcharge(as % of dividend tax) | Education cess(as % of dividend tax and surcharge) | Total | |

| April 1, 2003 – March 31, 2004 | 12.5 | 2.5 | Nil | 12.8125 |

| April 1, 2004 – March 31, 2005 | 12.5 | 2.5 | 2 | 13.0875 |

| April 1, 2005 – March 31, 2007 | 12.5 | 10 | 2 | 14.025 |

| April 1, 2007 – March 31, 2010 | 15 | 10 | 3 | 16.995 |

| April 1, 2010 – March 31, 2011 | 15 | 7.5 | 3 | 16.60875 |

| April 1, 2011 – March 31, 2013 | 15 | 5 | 3 | 16.2225 |

| April 1, 2013 – Sept 30, 2014 | 15 | 10 | 3 | 16.995 |

| Oct 1, 2014 – March 31, 2015 | 17.64706 | 10 | 3 | 19.99412 |

| From April 1, 2015 | 17.64706 | 12 | 3 | 20.35765 |

Position after Budget 2016:

For investors receiving dividend in excess of Rs 10 lacs per annum, budget 2016 proposes to tax at the rate of 10% of gross amount of dividend in addition to applicable dividend tax. Hence, additional tax @ 10% shall be payable by individual / HUF in case gross dividend received in financial year 2016-17 exceeds Rs 10 lacs.

Sec 115BBDA as inserted by sec 52 of Finance act 2016.

(1) Notwithstanding anything contained in this Act, where the total income of an assessee, being an individual, Hindu undivided family or a firm, resident in India, includes income in aggregate exceeding ten lakh rupees, by way of dividends declared, distributed or paid by a domestic company or companies, the income-tax payable shall be the aggregate of—

(a) the amount of income-tax calculated on the income by way of such dividends in aggregate exceeding ten lakh rupees, at the rate of ten per cent; and

(b) the amount of income-tax with which the assessee would have been chargeable had the total income of the assessee been reduced by the amount of income by way of dividends.

(2) No deduction in respect of any expenditure or allowance or set off of loss shall be allowed to the assessee under any provision of this Act in computing the income by way of dividends referred to in clause (a) of sub-section (1).

(3) In this section, “dividends” shall have the same meaning as is given to “dividend” in clause (22) of section 2 but shall not include sub-clause (e) thereof.’.

Is declaring dividend in always beneficial?

This depends on the facts of each case.

Case 1: In case payment is being made to a director, the company may have only three options, i.e., pay as dividend, as loan or advance or pay as remuneration. The result of each of these scenario is summarized as under:

- If paid as dividend: This will cost of company 20.35765% and no cost to director up to payment made of Rs 10 lakh. However any payment beyond Rs 10 lacs will cost adiitionally to director @ 11.536% or 10.3% as the case may be. Thus, overall tax bill for any payment beyond Rs 10 lacs is 31.89365%.

- If pay as remuneration: This will be tax saving for the company if payment does not come under disallowance and made within permissible limits of the companies act. However, it will be taxed in the hands of director @ 34.608% in case taxable income of director is above Rs 1 crore or 30.9% in other case.

- If paid as loan or advance: In this case such loan or advance shall be deemed to be income of director and taxable under his hand. This payment shall be taxable normally under the head income from other sources and all consequences as applicable in scenario b above will also applicable to his case also.

So, before taking decision as declaration of dividend, current taxable income of director shall be consider.

|

|

Due dates for the Month of November 2016

|

|

5th

|

Service Tax** – Service Tax payments by Companies for October ** If Service Tax Payment is done online, then the due date of payment of service tax is 6th. |

| Central Excise** – Duty Payment for all Assessees other than SSI Units for October ** If Excise Duty, Payment is done online, then the due date of payment of Excise Duty is 6th. |

|

|

7th

|

Income Tax – TDS Payment for October |

|

10th

|

Central Excise – Monthly Return in Form ER-1 (Ann-12) for other than units availing SSI exemption for October – Monthly Return in Form ER-2 (Ann-13) by 100% EOUs for October – Montly information relating to principal units in Form ER-6 (Ann – 13AC) for specified assessees for December. – Exports – Procurement of specified goods from EOU for use in manufacture of Export goods in Form Ann-17B for DTA units, procuring specified goods from EOU for manufacture of export goods. – Proof of Exports in Form Ann.-19, once in a month for all exporters, exporting goods under Bond – Export details in Form Ann.-20, for Manufacturing following simplified export procedure. – Removal of excisable goods at concessional rate in Form Ann. -46 for Manufacturers receiving the excisable goods for specified use at concessional rate of duty in terms of Rules described in Col. 4. |

|

15th

|

Provident Fund – PF Payment for October |

|

21st

|

ESIC – ESIC Payment for October MVAT * – MVAT Monthly Return for October (TAX>1000000/-). If paid in time additional 10 days for uploading e-return. |

|

30th

|

Income Tax – Return of Income and Wealth of all assessees covered under Transfer Pricing Regulations Profession Tax – Monthly Return (covering salary paid for the preceding month) (Tax Rs. 50,000 or more) Central Excise – Annual Financial Information in Form ER-4 (Ann. 13AA) for assessees who paid/availed credit of Rs. 1 crore or more in a year. – Particulars relating to clearances, electricity load etc., in Form Ann.-4 exceeding the limit of Rs. 90 lakhs of exempted clearances for small scale units availing exemption and whose turnover exceeds or has exceeded Rs. 90 lakhs in a financial year, as the case may be. |

|

Software Solutions Available on:

TDS | PAYROLL | WEB PAYROLL | WEB HRMS | XBRL | FIXED ASSET |INCOME TAX| SERVICE TAX | DIGITAL SIGNATURE | ATTENDANCE MACHINE & CCTV | DATA BACKUP SOFTWARE | PDF SIGNER |

|

|

Sensys Technologies Pvt. Ltd.

HO: 524, Master Mind1, Royal Palms, Goregaon East, Mumbai – 400 065. Tel.: 022-66278600 | Call: 09769468105 / 09867307971 Email: sales@sensysindia.com | Website: http://www.sensysindia.com Branches: Delhi & NCR | Pune | Bangalore | Hyderabad | Ahmedabad | Chennai | Kolkata |

|

|

Visit our BLOG for latest news and updates related to XBRL, Income Tax, HR & Payroll, PF / ESIC / TDS / PT etc.. Click here to visit Sensys BLOG

|

|

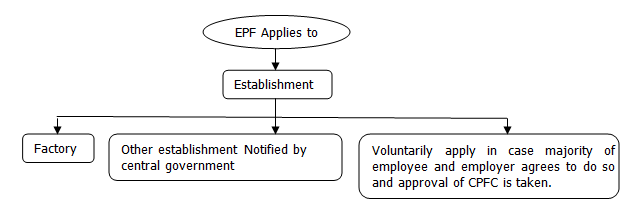

THE EMPLOYEES’ PROVIDENT FUNDS AND MISCELLANEOUS PROVISIONS ACT, 1952

Section 1. Short title, extent and application.-

(1) This Act may be called the Employees‟ Provident Funds and Miscellaneous Provisions Act, 1952.

(2) It extends to the whole of India except the State of Jammu and Kashmir.

(3) Subject to the provisions contained in section 16, it applies –

(a) To every establishment which is a factory engaged in any industry specified in Schedule I and in which twenty or more persons are employed and

(b) To any other establishment employing twenty or more persons or class of such establishments which the Central Government may, by notification in the Official Gazette, specify, in this behalf:

Provided that the Central Government may, after giving not less than two months‟ notice of its intention so to do, by notification in the Official Gazette, apply the provisions of this Act to any establishment employing such number of persons less than twenty as may be specified in the notification.

(4) Notwithstanding anything contained in sub-section 3 of this section or-sub-section 1 of section16, where it appears to the Central Provident Fund Commissioner, whether on an application made to him in this behalf or otherwise, that the employer and the majority of employees in relation to any establishment have agreed that the provisions of this Act should be made applicable to the establishment, he may, by notification in the Official Gazette, apply the provisions of this Act to that establishment on and from the date of such agreement or from any subsequent date specified in such agreement.

(5) An establishment to which this Act applies shall continue to be governed by this Act notwithstanding that the number of persons employed therein at any time falls below twenty.

From the above it can be said that Employees Provident fund is applicable to three types of establishment:

Situation 1:

Where the company is in the process of winding up an official liquidator has been appointed:

When the company is in the process of winding up and official liquidator has been appointed, the provident fund contribution need not to be deposited for a few employees who have been retained by the liquidator.

The court in the case of Regional Provident Fund Commissioners v Rohatas Industries Limited, observed that it is not in dispute that:

- Different units of the Company have been out of operation.

- These units were closed since a long time.

- They were not running at all at present.

The establishment was in the process of winding up and not engaged in any industrial activity specified in Schedule 1 nor specially notified under section 1(3)(b) of the act. Hence, in such circumstances establishment is not covered under EPF and hence contributions need not to be deposited.

Situation 2:

Will a factory or establishment be covered under the EPF Act when the construction activity has started and there are more than 20 workers?

The above analogy may be applied in the present case also. Since the specified activities are in the process of establishing the factory which is yet to come into existence and start operations. It does not meet the specification stipulated in section 1(3)(a). Hence, if the establishment is not notified under section 1(3)(b) the statutory requirement for applicability of the act provision is not fulfilled. Hence, no liability arises.

Conclusion

Hence, from the above discussion it can be safely concluded that a factory needs to deposited contribution only when in is working under normal operations. Contribution for construction period and post liquidation needs not to be deposited.

|

|

Due dates for the Month of October 2016

|

|

5th

|

Service Tax** – Service Tax payments by Companies for September – Service Tax payments by other than companies for July to September** If Service Tax Payment is done online, then the due date of payment of service tax is 6th. |

| Central Excise** – Duty Payment for all Assessees other than SSI Units for September – Duty Payment for SSI Units in respect of goods cleared during July to September** If Excise Duty, Payment is done online, then the due date of payment of Excise Duty is 6th. |

|

|

7th

|

Income Tax – TDS Payment for September |

|

10th

|

Central Excise – Monthly Return in Form ER-1 (Ann-12) for other than units availing SSI exemption for September – Monthly Return in Form ER-2 (Ann-13) by 100% EOUs for September – Quarterly Return in Form ER-3 (Ann-13A) for small scale manufacturers availing SSI exemption for July to September – Monthly information relating to principal units in Form ER-6 (Ann – 13AC) for specified assessees for November. – Exports – Procurement of specified goods from EOU for use in manufacture of Export goods in Form Ann-17B for DTA units, procuring specified goods from EOU for manufacture of export goods. – Proof of Exports in Form Ann.-19, once in a month for all exporters, exporting goods under Bond – Export details in Form Ann.-20, for Manufacturing following simplified export procedure. – Removal of excisable goods at concessional rate in Form Ann. -46 for Manufacturers receiving the excisable goods for specified use at concessional rate of duty in terms of Rules described in Col. 4. – Particulars in Form no. ER-8(Ann-13AE) for specified assessees paying 2% duty for July to September |

|

15th

|

Provident Fund – PF Payment for September Central Excise – Cenvat credit return in form 13B for registered dealers and importers for July to September |

|

21st

|

ESIC – ESIC Payment for September MVAT * – MVAT Monthly Return for September (TAX>1000000/-). If paid in time additional 10 days for uploading e-return. – MVAT Quarterly Return for July to September (TAX>100000/- and <=1000000). If paid in time additional 10 days for uploading e-return. |

|

25th

|

Service Tax** – Service Tax Returns for April to September for All Assessees |

|

30th

|

MVAT – MVAT half yearly return for April to September (Tax upto 100000/-) If paid in time additional 10 days for uploading e-return. |

|

31st

|

Income Tax – TDS Quarterly Statements for July to September Profession Tax – Monthly Return (covering salary paid for the preceding month) (Tax Rs. 50,000 or more) Central Excise – Particulars relating to clearances, electricity load etc., in Form Ann.-4 exceeding the limit of Rs. 90 lakhs of exempted clearances for small scale units availing exemption and whose turnover exceeds or has exceeded Rs. 90 lakhs in a financial year, as the case may be. |

|

Software Solutions Available on:

TDS | PAYROLL | WEB PAYROLL | WEB HRMS | XBRL | FIXED ASSET |INCOME TAX| SERVICE TAX | DIGITAL SIGNATURE | ATTENDANCE MACHINE & CCTV | DATA BACKUP SOFTWARE | PDF SIGNER |

|

|

Sensys Technologies Pvt. Ltd.

HO: 524, Master Mind1, Royal Palms, Goregaon East, Mumbai – 400 065. Tel.: 022-66278600 | Call: 09769468105 / 09867307971 Email: sales@sensysindia.com | Website: http://www.sensysindia.com Branches: Delhi & NCR | Pune | Bangalore | Hyderabad | Ahmedabad | Chennai | Kolkata |

|

|

Visit our BLOG for latest news and updates related to XBRL, Income Tax, HR & Payroll, PF / ESIC / TDS / PT etc.. Click here to visit Sensys BLOG

|

|

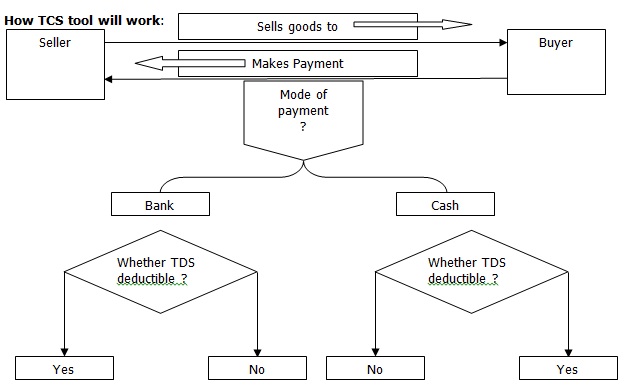

Tax collection on Cash payments

Section 206(1D)

Every person, being a seller, who receives any amount in cash as consideration for sale of bullion or jewellery 87[or any other goods (other than bullion or jewellery) or providing any service], shall, at the time of receipt of such amount in cash, collect from the buyer, a sum equal to one per cent of sale consideration as income-tax, if such consideration,—

(i) for bullion, exceeds two hundred thousand rupees; or

(ii) for jewellery, exceeds five hundred thousand rupees; 88[or]

88[(iii) for any goods, other than those referred to in clauses (i) and (ii), or any service, exceeds two hundred thousand rupees:

Provided that no tax shall be collected at source under this sub-section on any amount on which tax has been deducted by the payer under Chapter XVII-B.]

88[(1E) Nothing contained in sub-section (1D) in relation to sale of any goods (other than bullion or jewellery) or providing any service shall apply to such class of buyers who fulfill such conditions, as may be prescribed.

Why this section:

Indian economy was facing with some serious problems like:-

- Large flow of unaccounted cash in trading system resulting in loss of revenue and growth of economy.

- Large quantum of cash transactions in the sale of goods and services resulting in such transaction remain unnoticed to taxman.

Hence, there was a great necessary to bring high value transaction into tax net and promote more transaction via baking channel.

In essence the objective to introduce TCS on cash payment is to trace high value transactions.

Now, henceforth high value transactions can not remain unnoticed. Either these can be traceable via banking channels or can be traceable in the returns of buyers and sellers; as either buyer might have deducted TDS on such payments while making payment or buyer must have paid TCS to seller and must have claimed in his returns.

Practicable problems in application of TCS:

| Issue | Solutions | ||||||||||||||||||||||||

| Whether TCS shall be collected on each bill or aggregate value of bills made during a particular year? | While considering TCS, case of each transaction needs to be consider separately:For example:Mr X sold goods and received payment in the following manner:

Now for applicability of TCS bill no 1 & bill no 2 are two different transactions and as in both cases cash involvement is not more than two lacks and hence TCS need not to be collected. |

||||||||||||||||||||||||

| Whether TCS needs to be collected by an individual seller | Yes, if such individual seller is liable to get his accounts audited under income tax act. | ||||||||||||||||||||||||

| What if only part payment is made in cash? | TCS needs to be collected in part cash payment only if such part exceeds two lacs rupees. | ||||||||||||||||||||||||

| Whether TCS will be collected on total value of transaction or only such part which is paid in cash? | TCS will be collected only on such part payment which is made in cash. |

|

|

Due dates for the Month of September 2016

|

|

5th

|

Service Tax** – Service Tax payments for August ** If Service Tax Payment is done online, then the due date of payment of service tax is 6th. |

| Central Excise** – Duty Payment for all Assessees other than SSI Units for August ** If Excise Duty, Payment is done online, then the due date of payment of Excise Duty is 6th. |

|

|

7th

|

Income Tax – TDS Payment for August |

|

10th

|

Central Excise – Monthly Return in Form ER-1 (Ann-12) for other than units availing SSI exemption for August – Monthly Return in Form ER-2 (Ann-13) by 100% EOUs for August – Montly information relating to principal units in Form ER-6 (Ann – 13AC) for specified assessees for October. – Exports – Procurement of specified goods from EOU for use in manufacture of Export goods in Form Ann-17B for DTA units, procuring specified goods from EOU for manufacture of export goods. – Proof of Exports in Form Ann.-19, once in a month for all exporters, exporting goods under Bond – Export details in Form Ann.-20, for Manufacturing following simplified export procedure. – Removal of excisable goods at concessional rate in Form Ann. -46 for Manufacturers receiving the excisable goods for specified use at concessional rate of duty in terms of Rules described in Col. 4. |

|

15th

|

Income Tax – Advance Income Tax – All Assessees Providend Fund – PF Payment for August |

|

21st

|

ESIC – ESIC Payment for August MVAT * – MVAT Monthly Return for August (TAX>1000000/-). If paid in time additional 10 days for uploading e-return. |

|

30th

|

Income Tax – Return of Income and Wealth for others covered under Audit and Companies but other than covered under Transfer Pricing Regulations Profession Tax – Monthly Return (covering salary paid for the preceding month) (Tax Rs. 50,000 or more) Central Excise – Particulars relating to clearances, electricity load etc., in Form Ann.-4 exceeding the limit of Rs. 90 lakhs of exempted clearances for small scale units availing exemption and whose turnover exceeds or has exceeded Rs. 90 lakhs in a financial year, as the case may be. |

|

Software Solutions Available on:

TDS | PAYROLL | WEB PAYROLL | WEB HRMS | XBRL | FIXED ASSET |INCOME TAX| SERVICE TAX | DIGITAL SIGNATURE | ATTENDANCE MACHINE & CCTV | DATA BACKUP SOFTWARE | PDF SIGNER |

|

|

Sensys Technologies Pvt. Ltd.

HO: 524, Master Mind1, Royal Palms, Goregaon East, Mumbai – 400 065. Tel.: 022-66278600 | Call: 09769468105 / 09867307971 Email: sales@sensysindia.com | Website: http://www.sensysindia.com Branches: Delhi & NCR | Pune | Bangalore | Hyderabad | Ahmedabad | Chennai | Kolkata |

|

|

Visit our BLOG for latest news and updates related to XBRL, Income Tax, HR & Payroll, PF / ESIC / TDS / PT etc.. Click here to visit Sensys BLOG

|

|

GIST OF GST

Firstly GST will not reduce the amount of tax you pay, but it will make it less tiresome to pay and collect. GST is about fewer taxes, at unified rate, as we all know that the taxes are levied both by central and state government in indirect taxes in different level like vat , service tax, excise duty etc, what GST will do is to sweep (‘subsume’) many indirect taxes into a single label.

As things stand, the Centre has agreed to sweep excise duty and additional excise duty, service tax, countervailing duty, surcharge and cess and central sales tax into the waiting arms of GST. The States have obligingly agreed to give up VAT (sales tax), entertainment tax, luxury tax, taxes on gambling, octroi and entry taxes, cess and purchase tax. GST will thus replace all of these taxes.

When goods are shipped from one State to another, then it is called inter state , the Centre will collect an integrated GST retained its part of share and give state part of share to state government like if goods are moved from Uttar Pradesh to Haryana then it is called inter state, centre will collect GST and give state share to Haryana govt, When the goods are moved within a state then it is called intra state like from Uttar Pradesh to Uttar Pradesh then Central GST and State GST will be levied.

As we all know currently we are working on ‘value added’ tax regime where taxes paid on inputs are deducted from taxes due on final product, but this exists in name only because so many taxes like central sales tax, additional excise and customs duty, luxury tax, to name a few — are not eligible for such set-offs, As a result, both producers and sellers end up paying taxes on the same inputs over and over again.

It should be thanks that in case of GST there is no concept of input tax credit all taxes are summed up and GST is you pay just once for.

Now here is the meaning of some basic terms in GST like What does the word GOODS means in GST

Goods means all kinds of movable properties (which can be moved as such without any dismantling) (only tangible) eg:- visualize, marker, exercise machine, fan etc

INCLUDING securities, growing crops & grass, things attached to or forming art of the land e.g. electricity pole etc

EXCLUDING money, Actionable claim

What does the word SERVICES means in GST

ANYTHING OTHER THAN GOODS i.e. Do something or not to do something (like non competence contract, cancellation charges of hotel/ aircraft etc.)

INCLUDING intangible property (which cannot be touched like copyright, patent etc)

EXCLUDING Money

What does the word SUPPLY means in supply of goods/ services

If supply is for a consideration–

- All form of supply of goods/SERVICE :- exchange, transfer, barter, lease etc IN THE COURSE of business

- AGENCY SERVICES for supply or receiving goods/ services e.g. consignment agent

- Aggregator service e.g. meru cab/ uber/ Ola etc

In GST even if NO CONSIDERATION is there then also supply exists like-

- Stock transfer, supply of goods between two registered units/ branch

- Transfer of business assets:- PERMANENT transfer, temporary transfer, retained on De- registration

- Service put to pvt-use

- Import of service( business use or personal use)

Some clarification regarding supply of Goods v/s supply of services

In case of Movable Property (Goods)

- If there is sale of goods i.e. transfer of ownership then it is called supply of goods but

- if only “ RIGHT TO USE” is transferred then it is called supply of service

In case of business assets

- if it is permanent transfer then it is called supply of goods,

- but if temporary transfer then it is called supply of services ,

- if sold by third party (bank) then supply of goods by the person

In case of Immovable Property

- If there is Renting/ Leasing of immovable property then it is supply of service

- If sale of under construction property then also it is supply of service

In case of Intangible Property (IPR)

- Intangible property is either temporary or permanent transfer in both the cases it is supply of service

In case of software

- If the software is customised then it is supply of service

- But if the software is readymade then it is supply of goods

Goods on which 100% Exemption is there in GST

ROTI :- flour, pulse, rice, milk, cereals, poultry etc

KAPDA:- textile

MAKAN:- renting for residential/ construction for one family

SHIKSHA:- playway to XII- approved degree, diploma

SWASTHYA:- health care- diagnose, treatment , care etc

- THRESHOLD EXEMPTION OF GST IS RS 10 LAKHS means now all the small traders also covered under GST.

Courtesy: Eshaa Agarwal